Accurate, Reliable, and Insightful — Bookkeeping That Works for You

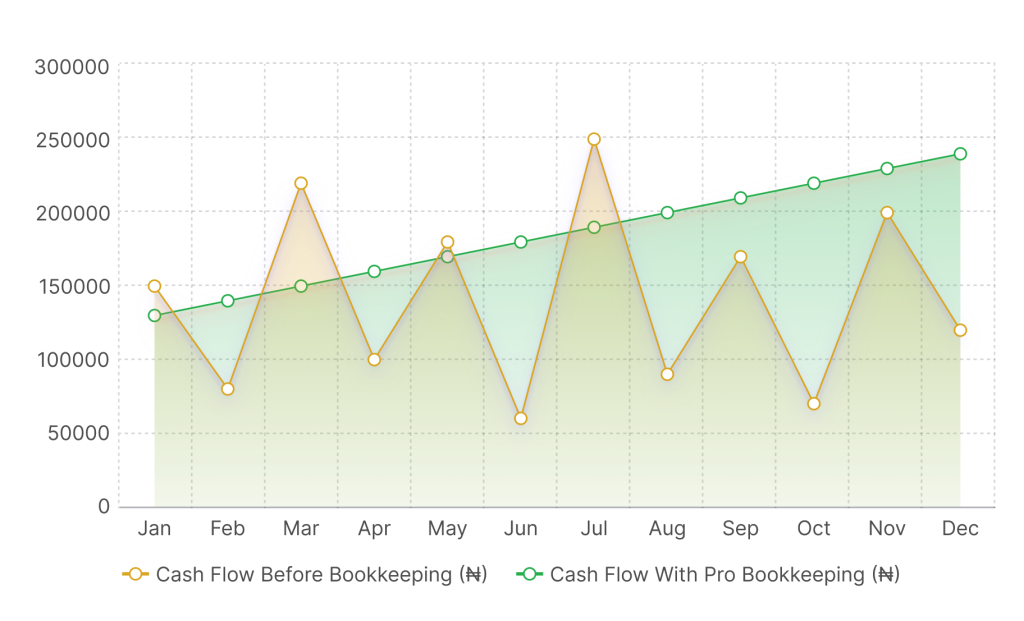

Beyond just recording numbers, our Bookkeeping & Financial Reporting service transforms your raw financial data into clear, actionable insights. We meticulously handle every transaction, reconcile accounts, and organize your books with unparalleled accuracy.

You’ll gain complete, real-time visibility into your financial health through expertly prepared Profit & Loss, Balance Sheet, and Cash Flow statements. This robust foundation empowers you to make confident, data-driven decisions, anticipate trends, and strategize for sustainable growth, giving you the clarity and control essential for long-term success.

Unlock clarity, control, and peace of mind that powers better decisions with perfectly balanced books.

Why Accurate Books are Your Strategic Advantage

In today’s dynamic market, guessing is no longer an option.

Accurate bookkeeping isn’t just about compliance; it’s the intelligence system for your business, providing the granular financial insights necessary for confident expansion and effective resource allocation.

Unreliable data leads to missed opportunities, poor cash flow, and tax complexities. Professional bookkeeping ensures every transaction tells a true story, providing the precise financial insights needed for confident growth, strategic planning, and securing vital investments, transforming your raw numbers into a powerful engine for success.

What's Included

We provide comprehensive, tailored bookkeeping solutions:

- Categorized Transaction Recording: Every income and expense accurately tagged

- Seamless Reconciliation: Bank, credit card, and other accounts perfectly balanced

- Accounts Payable & Receivable: Clear tracking of what you owe and what’s due

- Custom Chart of Accounts Setup: Optimized structure for clear financial data

- Essential Financial Statements: P&L, Balance Sheet, and Cash Flow Reports

- Cloud-Based Bookkeeping Tools: Leveraging technology for efficiency and access

- Dedicated Expert Support: A real human professional understanding your business

- Audit-Ready Documentation: Organized records prepared for any scrutiny

Who Needs Professional Bookkeeping?

- Service professionals and consultants

- Startups and growing SMEs

- Law firms, creative agencies, healthcare providers

- Product-based businesses needing inventory tracking

Let's Build Your Financial Backbone

Our bookkeeping isn’t cookie-cutter. We assess your business model, workflows, and goals, then create a bookkeeping system that integrates seamlessly with your operations, giving you the financial clarity required for confident decision-making.

Strategic Tax Planning: Optimize Savings, Ensure Compliance

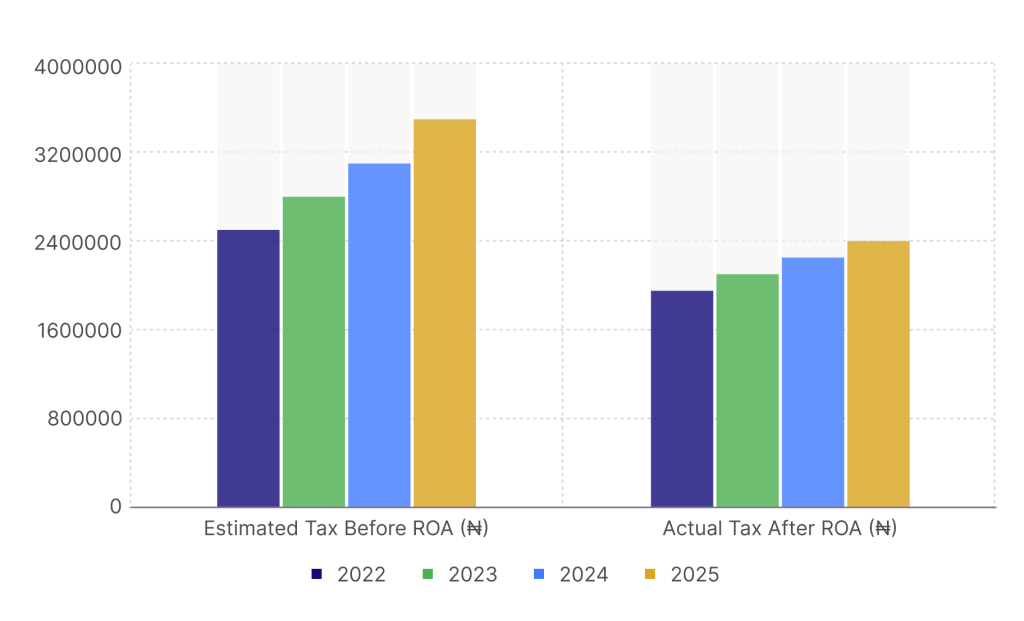

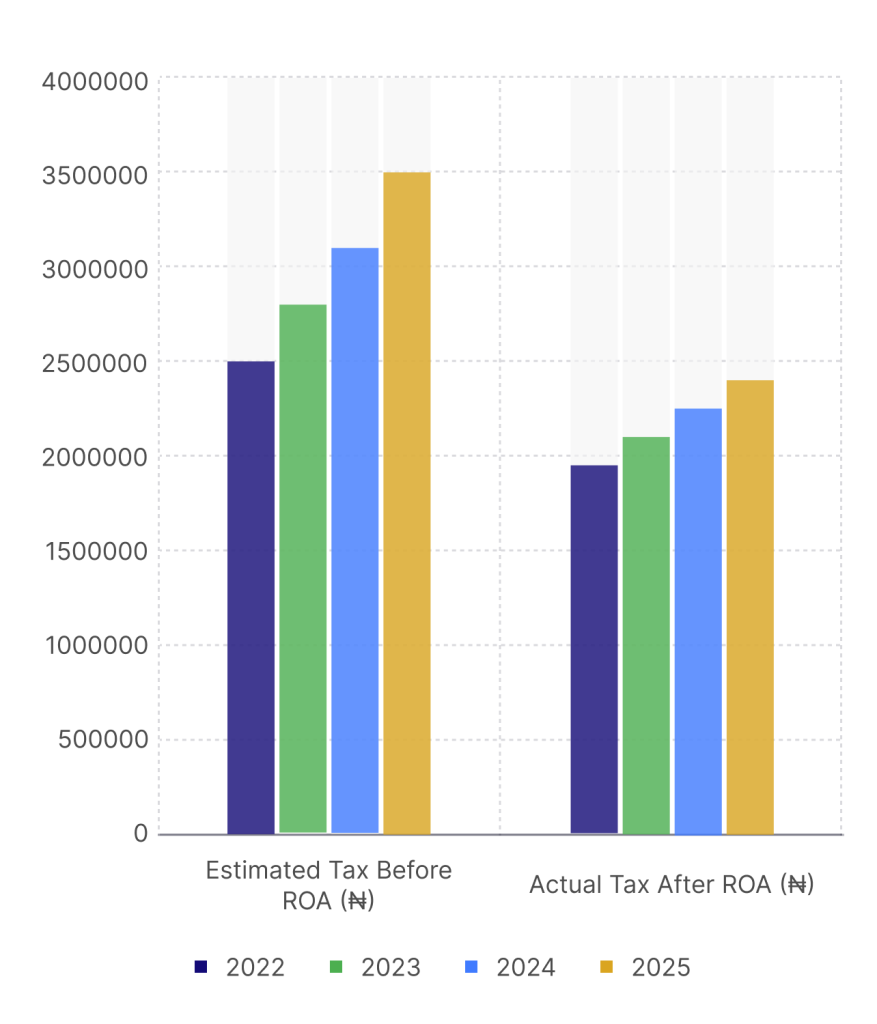

Stop guessing, start leading. Taxes are inevitable, but overpaying or facing surprises doesn’t have to be.

Our Tax Planning & Compliance service transforms taxes from a yearly burden into a strategic advantage. We provide proactive, year-round guidance, meticulously identifying tax-saving opportunities and ensuring airtight compliance with ever-evolving regulations.

This approach minimizes your liabilities, prevents costly surprises, and frees you to focus on what truly matters—growing your business with confidence and financial peace of mind.

Beyond compliance: turn taxes into a powerful advantage, make every naira count.

Why Proactive Tax Management is Essential: Paying Taxes Isn't Optional

However, how much you pay — and how prepared you are — is completely within your control.

Tax season stress and financial surprises are often the result of reactive planning. Poor or last-minute tax strategies can lead to significant overpayments, missed deductions, and costly penalties, impacting your cash flow and long-term financial health.

Beyond mere compliance, a well-executed tax plan helps you maximize savings, allocate resources efficiently, and confidently navigate audits. It’s about turning taxes into a powerful tool for financial optimization, ensuring every Naira or Dollar contributes strategically to your business’s success.

What's Included

Our comprehensive tax planning and compliance service covers all essentials:

- Strategic Year-Round Planning: Proactive strategies tailored to your unique financial situation.

- Individual & Business Tax Filing: Accurate, timely preparation and submission.

- Quarterly Estimated Tax Calculations: Precise calculations to avoid penalties.

- Compliance Support: Expert guidance on IRS and state regulations, ensuring adherence.

- Tax-Saving Opportunities: Identifying deductions, credits, and incentives you qualify for.

- Audit Preparedness: Thorough documentation and support for any potential audit. Entity Structuring Advice: Guidance on the optimal business structure for tax efficiency.

- Minimizing Tax Burden: Expert support to ensure you keep more of what you earn.

Who Needs Strategic Tax Planning?

If minimizing liabilities, avoiding surprises, and maximizing your take-home are priorities, this service is for you.

Whether you’re a freelancer, small business owner, high-income earner, or a rapidly growing company, proactive tax planning helps you save money, stay compliant, and ensures you have a tailored financial plan for success.

Let's Build Your Tax Game Plan

We’ll assess your current financial landscape, uncover every possible saving opportunity, and craft a personalized year-round tax strategy.

With our expert insight and proactive support, you’ll always be prepared—maximizing benefits, minimizing stress, and keeping your finances on the winning side for sustained growth.

Automated Payroll & Expense Management: Effortless Efficiency

Imagine a world where payday runs itself and expense reports reconcile with minimal effort. Our Payroll & Expense Management service transforms tangled spreadsheets and frantic last-minute tasks into a smooth, automated workflow.

Whether you’re paying a small team or managing contractors across regions, we make it effortless, accurate, and compliant, handling everything from onboarding new hires in minutes to calculating complex deductions and managing reimbursements from receipt to ledger without bottlenecks. This ensures every payment is accurate, on time, and compliant.

Gain real-time visibility into your spending, reclaim valuable administrative hours, and cultivate happier employees, allowing you to focus on your people and growth, not paperwork.

Pay your team and track your spend — accurately, on time, and without stress.

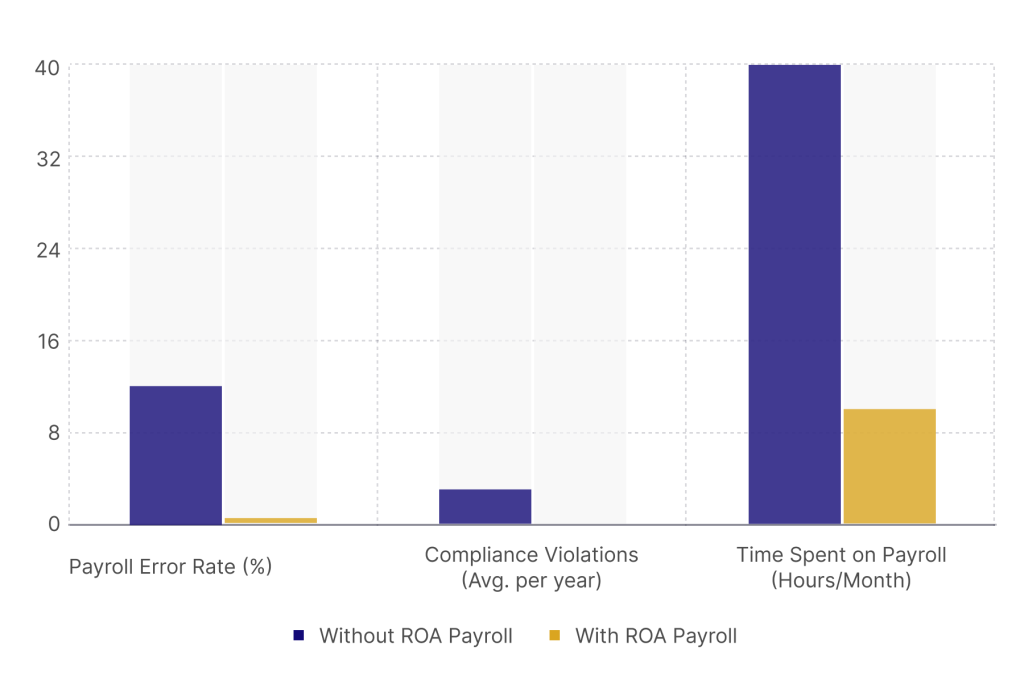

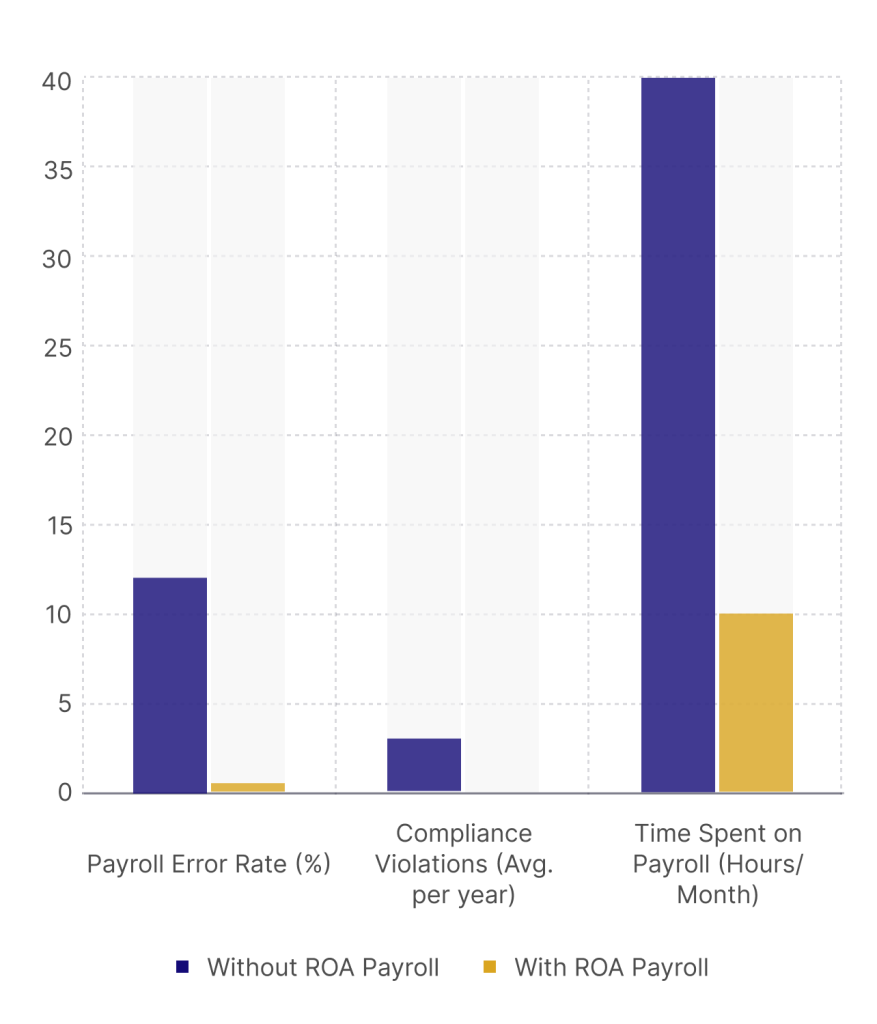

Why Seamless Payroll & Expense Control Matters

Payroll isn’t merely about paying salaries; it’s a critical function for compliance, morale, and financial stability.

Errors or late payments can lead to costly fines, audits, or dissatisfied employees, creating significant operational disruptions and eroding trust within your team. Likewise, uncontrolled expenses drain profitability.

Our service ensures a smooth, accurate, and compliant process from start to finish, from setting up pay structures to managing deductions and direct deposits.

You gain peace of mind, knowing every financial obligation is handled with precision and strategic foresight.

What's Included

We manage all the moving parts so you don’t have to:

- Automated Payroll Processing: Accurate, timely, and compliant payouts every cycle

- Streamlined Employee Onboarding: Quick setup for new hires

- Precise Tax & Benefits Deductions: Handled correctly each cycle

- Efficient Expense Reporting: Fast and transparent approvals for reimbursements

- Flexible Multi-state & Contractor Support: Seamless management across regions

- Integrated Monthly Journal Entries: Sync with your accounting books

- Auto-Generated Payslips & Reports: Easy access to year-end summaries

- Cloud-Based Tools & Compliance Monitoring: Stay ahead of labor laws and tax changes

Who Needs Automated Payroll & Expense Management?

If you employ staff, work with contractors, or have recurring business expenses, this service is essential.

Gain control over your spending and ensure your team is always paid accurately and on schedule.

Let’s Build Your Ideal Payroll Workflow

We design a customized system that perfectly suits your business operations. This includes automated runs, proper approvals, and detailed tracking.

You’ll have more time to focus on growing your team and achieving your strategic goals.

Strategic Advisory: Forward Thinking, Backed by Numbers

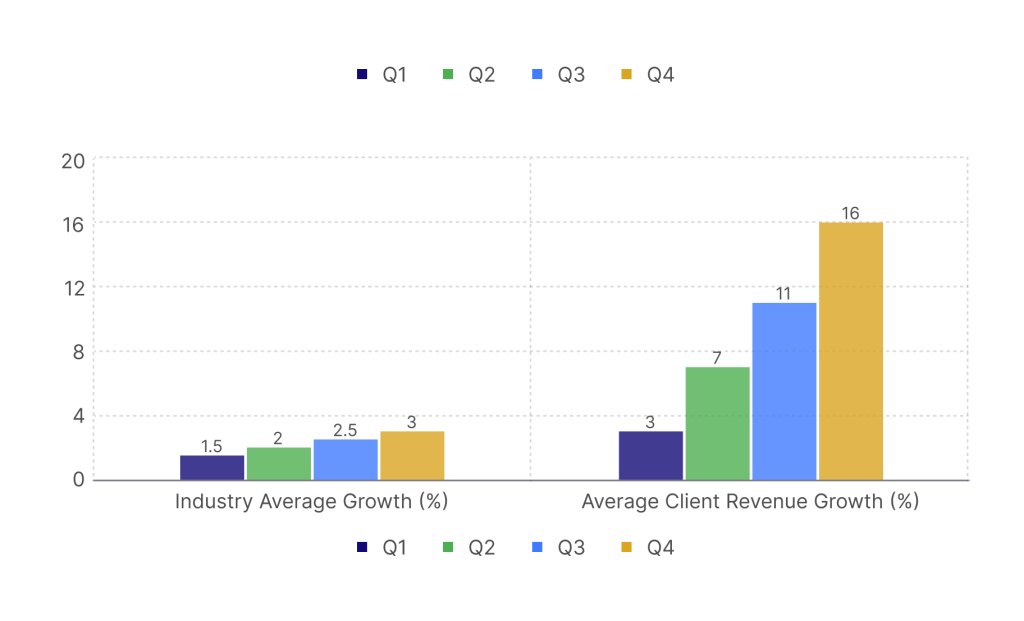

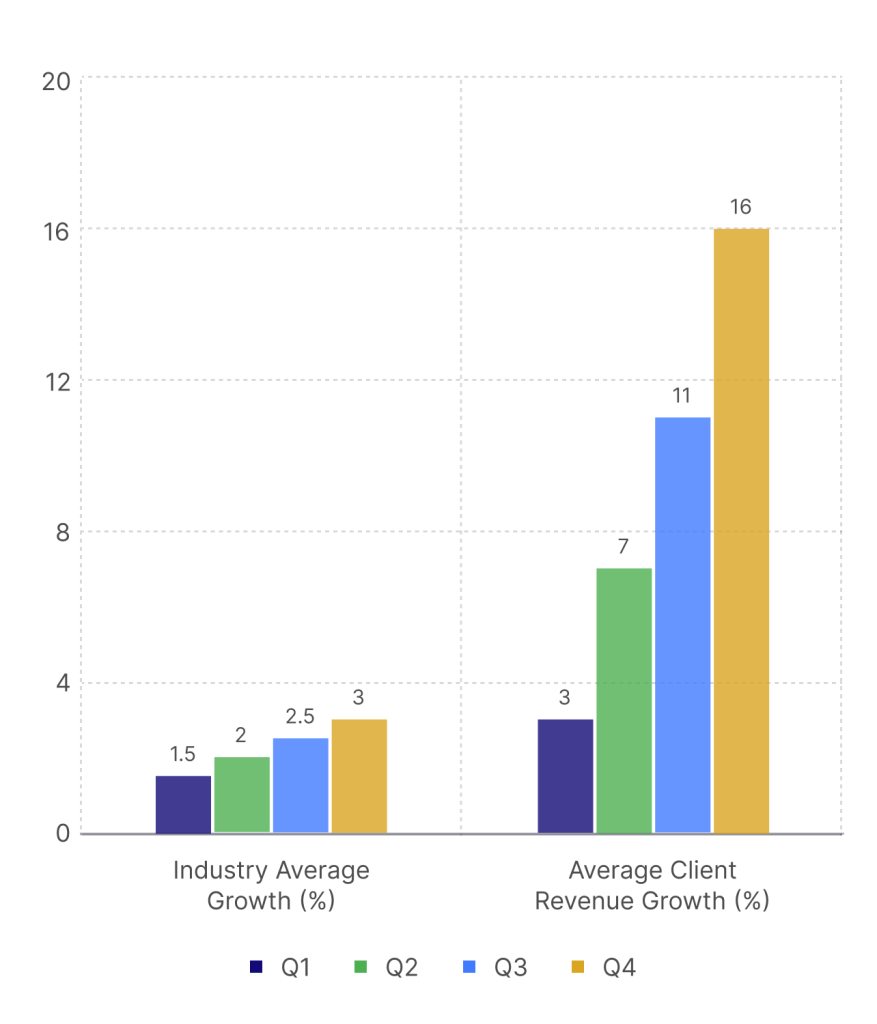

Whether you’re launching, scaling, or stabilizing, decisions backed by expert financial insight make all the difference. Our Business Advisory & Strategy services go beyond crunching numbers; we connect the dots.

We help you interpret your financial data, identify untapped opportunities, and build a clear roadmap for sustained growth. With deep industry knowledge, real-time analysis, and tailored advice, we guide you in making smarter, proactive moves today for a stronger, more profitable tomorrow. Transform guesswork into planned, measured, and intentional progress.

Growth doesn’t happen by chance — it’s planned, measured, and intentional.

Why Smart Strategy Isn't Optional

Great businesses aren’t built on guesswork. Without a data-driven plan, you risk wasted resources, missed opportunities, and stunted growth, leaving you vulnerable in a competitive market.

Strategic advisory is your second brain, offering the financial clarity and insight needed to guide your next move.

It ensures you make decisions with confidence and a long-term view, backed by proven models, expert analysis, and measurable data that actually move the needle, transforming uncertainty into a clear path for sustained success.

What's Included

Our comprehensive advisory service delivers actionable insights, covering:

- Strategic Planning: Defining goals, timelines, and execution plans for growth.

- Financial Modeling: Forecasting revenue, expenses, and growth scenarios.

- KPI & Dashboard Setup: Focusing on key metrics for your success.

- Business Health Reviews: Providing regular financial performance insights.

- Market & Competitor Analysis: Understanding your position and advantages.

- Risk Assessments: Identifying and mitigating financial threats proactively.

- SWOT & Opportunity Mapping: Comprehensive business analysis for all angles.

- Investment & Pricing Strategy: Crafting compelling offers and budgets for sustainable growth.

Who Needs Strategic Advisory?

This service is for business leaders seeking clarity, control, and a competitive edge. It’s ideal for:

- Founders needing clear direction.

- CEOs scaling operations effectively.

- Operators striving for improved margins.

- Anyone making critical decisions who needs expert financial insight.

Let’s Build Your Strategy

You bring the vision; we’ll help shape the plan—grounded in numbers and tailored to your specific goals.

We’ll collaborate to create a bold, realistic growth roadmap that aligns your operations with smart financial moves, measurable milestones, and long-term impact, transforming potential into tangible success.

Strategic Finanace, On Demand— Big Picture Thinking, Without The Full-Time Salary

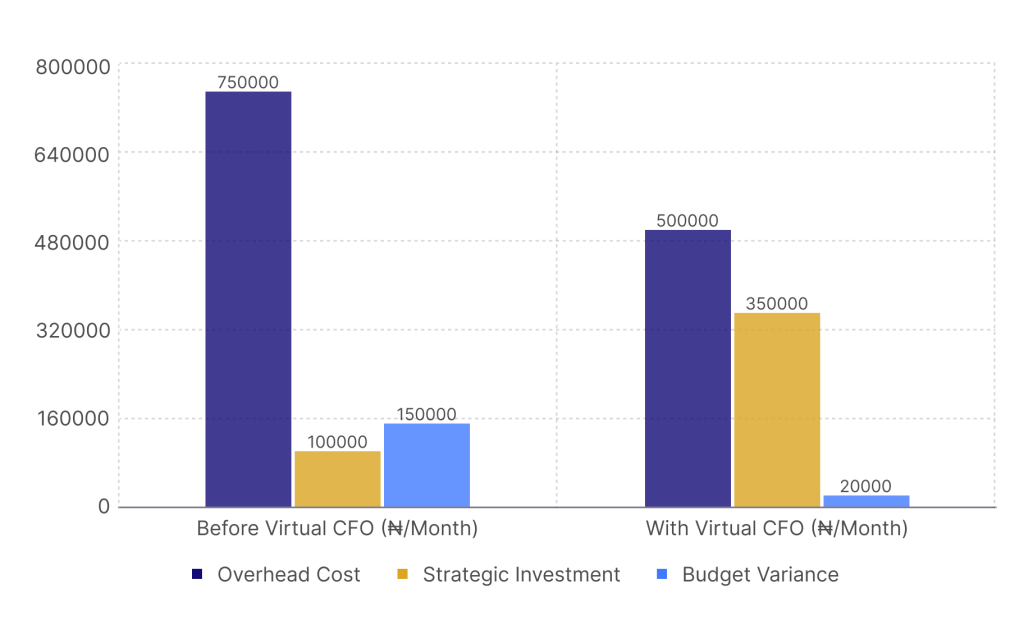

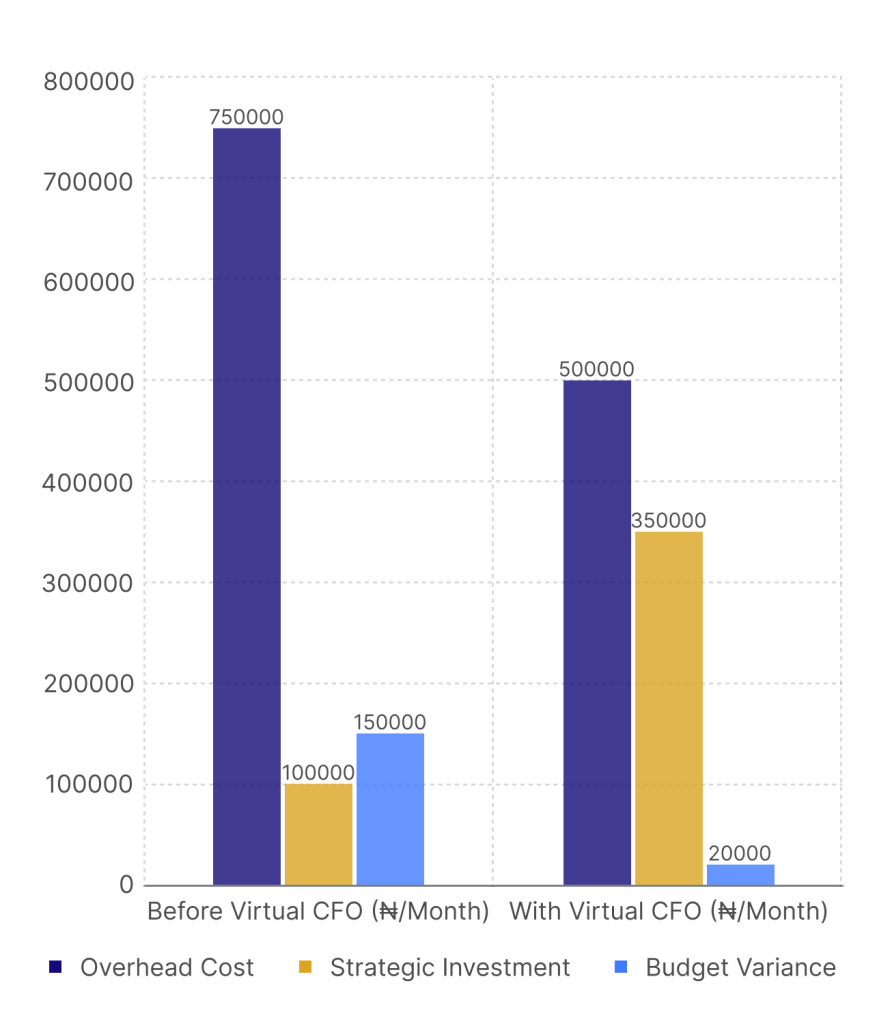

A CFO (Chief Financial Officer) is your company’s senior financial strategist. Our Virtual CFO service grants you instant access to high-level financial strategy and executive insights.

You gain expert guidance on major money decisions, ensuring your business remains financially healthy and poised for the future, all without the overhead of a full-time hire.

From sophisticated cash flow forecasting to investor preparation and robust internal controls, we empower you to scale with structure, make informed decisions, and confidently manage rapid growth. We act as your trusted financial right-hand, enabling you to lead with unwavering confidence.

Executive-level insight without the executive-level overhead.

CFO Guidance Isn’t Just for Big Companies

Growing businesses face complex decisions—about pricing, team expansion, investor expectations, and cash flow. Without financial leadership, you risk scaling too fast, overspending, or missing funding opportunities.

Our Virtual CFO brings the strategy, structure, and foresight to help you lead smarter and grow stronger—without the cost of a full-time hire.

What's Included

Cash Flow Forecasting – Anticipate inflows/outflows and plan ahead

Budgeting & Variance Analysis – Track performance vs. plans

Board & Investor Reporting – Clean, concise updates that build trust

Financial Modeling – Scenario planning for growth or downturns

Revenue & Cost Optimization – Find opportunities to increase margin

Internal Controls & Oversight – Reduce financial risk

Fundraising Support – Pitch deck inputs, due diligence, and investor confidence

Stakeholder Liaison – We bridge finance, ops, and leadership with clarity

Who Needs CFO?

If your business is growing, fundraising, or facing complex financial decisions, a CFO can bring clarity and strategy.

Startups seeking investor confidence, small businesses scaling fast, or companies needing to streamline costs all benefit from expert financial leadership — without the overhead of hiring in-house.

Let’s Elevate Your Financial Game

Stop guessing, start leading. Let’s turn your financial data into a clear roadmap for sustainable growth—with expert strategic oversight, investor-ready reporting, and operational insight.

This drives maximum profitability, efficiency, and lasting long-term value, positioning you for success.

Your Financial Command Center: Unlock Your Data's Power

Imagine a single screen where every critical financial metric—from cash flow to profitability—is updated in real-time, presented in a way you can instantly understand.

Our Smart Tools & Dashboard service isn’t just about software; it’s about transforming raw data into actionable intelligence. We set up intuitive, cloud-based dashboards tailored to your specific business needs, integrating seamlessly with your accounting systems.

Get instant insights into your revenue, expenses, and key performance indicators (KPIs) with a single click. Receive custom alerts for budget variances or cash flow trends. This empowers you to make smarter, faster decisions, identify opportunities, and proactively steer your business towards its goals, all from one centralized hub.

Gain instant clarity and control—your entire financial world, at your fingertips.

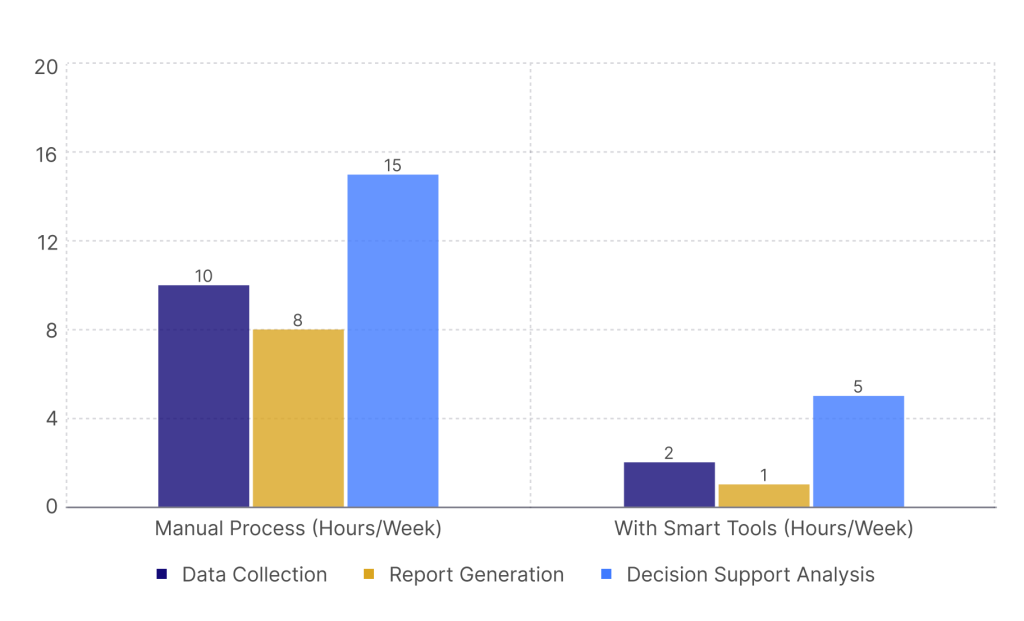

Why Smart Tools & Dashboards Are Crucial

In today’s fast-paced business world, timely financial information isn’t a luxury—it’s a necessity. Relying on outdated reports or disconnected spreadsheets means delayed decisions and missed opportunities, hindering your ability to react swiftly to market changes and capitalize on emerging trends.

Smart tools and interactive dashboards provide real-time visibility, allowing you to quickly spot trends, identify inefficiencies, and capitalize on growth potential. They turn complex data into simple, digestible insights, making financial management proactive rather than reactive.

What's Included

We customize and manage your financial dashboard experience:

- Dashboard Setup & Customization: Tailored to your key metrics and KPIs

- Real-time Financial Reporting: Instant access to revenue, expenses, and profitability

- Cash Flow Forecasting: See future liquidity at a glance

- Budget vs. Actual Tracking: Monitor performance against your goals

- Customizable Alerts: Get notified of critical financial events

- Cloud Integration: Seamlessly connects with your existing accounting software

- Data Visualization: Complex data presented in easy-to-understand charts

- Interactive Drill-downs: Explore underlying data for deeper insights

- Secure Access: Your financial data, safe and accessible anywhere, anytime

Who Needs Smart Tools & Dashboards?

Any business owner craving instant financial clarity and a competitive edge.

If you want to make data-driven decisions, monitor performance actively, and free yourself from endless spreadsheets, this service is for you.

Let’s Build Your Financial Command Center

We’ll identify your key financial drivers, configure the perfect dashboard, and integrate it with your existing systems.

You’ll gain unprecedented control and foresight, transforming how you manage and grow your business.